When people hear the word “stock market” they either dream of getting reach or lossing everything. But that is not tue, reallity is something different, it lies somewhere between. Many new investors lose money in stock market just beacuse they believe in a wrong ideas or they follow misleading guides.

In this article, we are going to talk about the common myths that misguide first-time investors. But before we go ahead, we would like to share some articles with you which might help you, if you are a first-time investor:

Myth 1: The Stock Market is Only for the Rich People

One of the common myths is that people think “investing is only for those who already are wealthy, I have only $100 left each month, how possible, I can’t invest, it’s just not possible for me.”

Reality: The reality is that anyone can start investing with a small amount. There are many options available for small investments like Mutual funds, SIPs, and even fractional stocks. It doesn’t matter how small your investment is, but the stock market is such a nice way to grow your money.

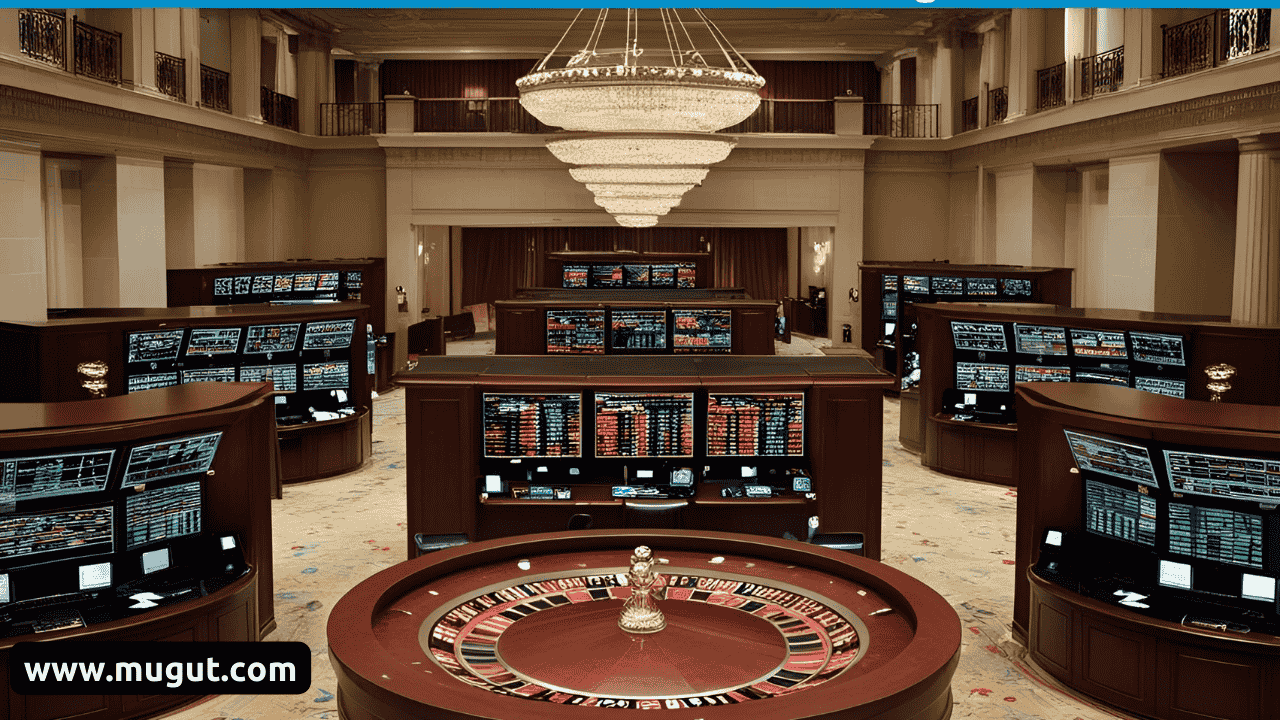

Myth 2: The Stock Market is Gambling

This is one of the most common myths. Many people think, “It is the kind of gambling, who know when the market will go up or down.”

Reality: It is always a great idea to invest in the long term; in the short term market can be unpredictable. But investing in good companies after proper research will always give you the best returns in the long term.

So what is the difference between investing and gambling?

There is a very big difference; gambling is based on chance, and investing is based on logic. What’s your thought on it? Let us know.

Myth 3: Money Doubles Quickly in the Market

It is the era of social media, people share their profiles on Facebook, Instagram, Twitter(X), and WhatsApp (Status). They write something like “My money doubled in 30 days” and and new investor believes it’s normal to double money in just 30 days in the stock market.

Reality: Building real wealth takes time; in order to build real wealth, you need to have patience and consistency. It’s like a marathon to make money from the stock market, not like a sprint.

Myth 4: The Stock Market is Only for Experts

Many people think, “I do not have much knowledge about finance, how can I invest? This is only for finance professionals, not for me.”

Reality: Nowadays, we have the power internet and AI. On the internet, there is content for all levels. We just need to learn. AI can also be used as a personal assistant. Using apps and platforms, anyone can easily invest.

Myth 5: One Stock Can Change Your Life

People think that if I buy a stock, it will change my life forever. People with such thinking invest blindly in someone’s advice. They think their life will be set soon.

Reality: Such a stock is very rare. To build real wealth, use a diversification method. Diversification means putting your money into different stocks and asset classes.

Myth 6: Buy Only Cheap Stocks

Some new investors think cheap stocks are better than costly stocks, as there is a chance to go up. They are afraid of stocks with high prices.

Reality: Price never matters; It is the quality of the company that matters most.

Myth 7: You Can Time the Market

Some people think they can time the market perfectly. How? Well, they buy stocks when the market is down in believe it will rise in a few days.

Reality: Even investors with more than 10 years of experience fail to time the market.

Myth 8: You Must Check the Market every day

New investors keep checking the prices every day. If they notice even a little drop in price, they panic.

Reality: If you are a long-term investor, it is not necessary to check the prices on a daily basis. Doing this can give you only stress. You should let your investment grow.

Myth 9: Tips are Enough to Invest

Many new investors rely on the tips only. They invest if their friend suggests the stock or someone on YouTube recommends it.

Reality: Every tip is not really suitable for every investor. Everyone has a different goal and risk level. You need to do your own research.

Myth 10: If You Face a Loss, Stop Investing

Many people think, “This is not for me” after their first loss. And they just quit.

Reality: It is normal to face losses in investment, even big names like Warren Buffett have faced many losses. After a loss, you should learn from your mistakes and must not repeat again.

Myth 11: Investing Means Only Buying Stocks

Many beginners believe investing means buying stocks. But this is not completely true.

Reality: A real investor doesn’t just buy stocks but also invests in mutual funds, gold, and real estate, bonds and etc.

Myth 12: You Can Earn Monthly Income from the Stock Market

Some new investors think they can earn a monthly income like a salary from the market.

Reality: The Stock market is not a regular source of income, unless you have a dividend stock portfolio or actively trade.

Myth 14: Once You Start SIP, Forget About It

Most people who plan to invest in SIP think that once they start it, their job is done.

Reality: Market conditions and goals can change, so it is important to review regularly. It is also important to monitor SIPs.

Myth 15: Only Technical Analysis Works in The Stock Market

New investors think that without indicators and charts, it is not possible to invest. We should have knowledge of creating such things.

Reality: The fundamental analysis is also equally important.

Conclusion

It is not so hard to become successful in the field of investment, but you need to work hard. You need to know the difference between truth and myths. If new investors avoid some common myths, they can avoid losing money and will be able to make better decisions. You should understand, it is not possible to learn everything in one day, but you can learn something every day.